Hello All !!

Back Again, continuing the Series MARKET OUTLOOK.

I have Promised to Post 30 Stocks in this series and Already Posted 14 Stocks in this Series, Analysis of Major Indian and International Indices was also posted in the Series Initially. Everything is Moving Perfectly as Posted Including Every Index In India and International Markets. Big Targets are Achieved which Normally are dream moves for Many. But as I said Earlier.. Free Things Lose their Value!!

The Ready Analysis of Indices is Posted Few Weeks Back and Updated Many times Through many WhatsApp Groups, But Who Cares to Read and Follow the Levels. Traders Need Daily New Update for 20-30 points.

Each and Every Stock Posted in the Analysis has Performed Exceptionally Well and Given Superb Returns.

Find All The Posts in This Series by Scrolling Down on the Blog. You will have to take Small Efforts of Scrolling :)

-----------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------

Let's Start with Today's Stocks and Their Analysis :

First Stock to To Covered here Will be

INOX LEISURE LTD.

One More Stock in Entertainment Sector.. First One Was Balaji Tele.

Let's See the Charts

This is a Monthly Chart,

As Per the Chart, The Stock is Performing Well and Moving along with the Rising Trend Line Since a long Time of about 11 Years. After Crash of 2008, The Low Made in 2009 was never revisited by this Stock.

Next We are Comfortably Trading above a Support of Long term at 244 which was a Resistance in Past, in 2007-2008. It has been working Perfectly in Previous few years also.

We may See a Strong Bounce by making a Long Pin bar in April 2020, The March low was also made on a Previous Support.

May Month Candle Was a Perfect Strong Body Candle, to Support the Long Pin bar Formation at Support. After Crossing 244, The Risk of Downfall Reduced drastically. Next Resistance is placed around 295 and 383 levels. One More Important Resistance is the 50 Period Simple Moving Average.

Let's See Next Chart on Lower Time Frame :

In this Chart, I have Marked all Support & Resistances which are working fine since last 4 years. You may find it very easy for Trading after studying this Chart. The Latest Support was also Taken Perfectly on the Rising Trend Line. It was breached in panic but managed to Break and Trade above the Trend Line.

Next Important Resistance are the 200 Period Simple Moving Average, Resistance at 295 & 383 levels.

I am Expecting the Stock to Perform Well in the Post COVID Scenario. Reasons are simple. After a Long Break, there will be a Strong Footprint of Customers for them as We Indians can't live without Cinema. The Company will also Change many things slowly, Increasing Presence in Different Segments to Reduce Such Impacts will be the preference. Social Distancing and Screening Precaution will increase confidence in customer attraction. Many Pending Movie Launches will start effectively soon. After a Big Impact of Lock Down, Next Quarter will be good. We all know, Stocks Run on Hope Only.

I recommend the Stock for Short to Mid Term Holding, It's a BUY !!

Recommendation here is :

BUY INOX LEISURE LTD.

Stock Moved up to 317 in a Hurry before I can even post the Chart and Analysis. Now Reversed to 285.

BUY Near 240-250,

Add On Dips to 220,

Stoploss will be 190

Targets will be : 288 - 377 - (if 383 is crossed and sustains) We will See 499

Holding Period will be 12-18 Months. I expect the Stock to Double.

The Risk : Reward is Amazing.

Risk from Average Buy is approximately 40 Rs.

Reward from Average Buy is approximately 58 - 147 - 269 Rs.

This is a fairly Good Deal for any Equity Investor !!

Though The Stock may face big Resistance around 295, We may expect good returns in 12-18 months.

Calculate your Risk, Apply your Strategies, Plan the Trade and Execute... !!

Very Short Term Traders... This May be Risky for you. We Might see big ups and Downs in this Counter.

Moving On to Next Stock...

-----------------------------------------------------------------------------------------

Next Stock in Our Watch list is :

ZENSAR TECHNOLOGIES LTD.

A Stock from IT Sector ..

Starting with Monthly Chart ..

Zensar Technologies , I have no ideas about the Fundamentals but Technically The stock looks great for a Superb Move.

Monthly Chart Shows a Rising Channel since 1998 till now, Size of the Channel is big so upper and lower ends are far away. The Main Support Line of the Channel is very rarely touched, As per the Chart, It is touched Twice only. First was in 1998 and then during Market Crash of 2008-2009.

The Stock this time Touched Lows in March 2020, The Lows done were around the Highs IT Boom of 2000. The Stock Fail Drastically in last 12-18 months from the Channel Resistance to the Channel Support. As We can see a Support From 200 Period Moving Average also worked near the lows.

The Stock Reversed From the Lows around 60 levels, Moved Above the 200 Period SMA and Above the Resistance which worked Well in 2000. Stock is comfortably moving above the Levels which will work as a Support now onwards. Next Resistance is placed around 148 levels only.

Stock was trading around 100 levels when chart was downloaded, After the day Stock Moved 20% exactly on the next day. I was unable to Publish the blog due to Connectivity and Electricity issues due to the Thuderstorm #Nisarga. Yesterday The Stock corrected with market.

Let's See a Little Closer View..

This was the Structure on Daily Chart, The Stock Closed Slightly above the Resistance giving a nice Breakout and The Next day we saw a sharp 20% upside move. Now the Stock will Relax a bit and Will give an opportunity for entry to all those who missed the stock. Currently Trading around 114, I am Expecting the Stock to Cool down before further move.

The Recommendation here will be BUY the Dips !!

Buy ZENSAR TECHNOLOGIES LTD.

Cmp : 114

Buy on Dips 100-111

Stoploss : 85

Targets : 144 - 222

The Stock has the Potential to Double From it's Current Rates. The Ride will not be an easy ride. Risk : reward in this case is amazing. 20 Rs. Risk For a Reward of 100 - 111 Rs. gain is a Mouthwatering Trade for any Equity Investor.

Trade Carefully as the Stock may move wild. Call us For Such Amazing Stocks Regularly. If You Haven't Joined Our EQUITY PLUS and EQUITY MARVELS Services, Please Be Fast ... WE ARE CLOSING EQUITY PLUS (2.0) .. in 2 Days.

-----------------------------------------------------------------------------------------

EQUITY PLUS (2.0) is a Journey from 2 Lacs to 1 Crore... Details are Available on the Blog. Check Top of the Blog and Click on the 2nd Tab Near Home Tab.

The Link is here EQUITY PLUS (2.0) Hurry up !! Only 8 Seats Left !!

-----------------------------------------------------------------------------------------

Next Stock in Our List is a SUGAR Stock.

BALRAMPUR CHINI MILLS LTD.

Monthly Chart of Blarampur Chini Shows a Strong Counter moving in Rising Trend continuously since last 20 years. The Stock wasn't able to Cross a All time high of 180-190 since last 14+ years. Many Corrections are seen in this Stock and it returned to Supports and Trend lines Multiple times, Whenever touches the Supports, Moves up again respecting the Supports. The Stock is seen to move within some boundaries everytime. It gives us a extremely Predictable Stock to Trade. Buy at Support, Sell at Resistance kind of Stock. Even a Kid Can Understand the Buying/Selling in this Stock.

Recently touched a Trendline Support, Reversed Sharply to form a Long Pin Bar Candle, Moved Near the Stronger Level of 99 for quite sometime, again The Candle was a Strong Bullish Candle in May, Exactly on Trendline Support. The 100 Period Simple Moving Average Worked Perfectly in this area. After the Strong Close in may. The Stock Moved Above the Resistance on 99 and Strongly trading above the level. When the Chart was downloaded, the Stock was trading around 112 levels, Today it is trading around 125 levels.

Recommendation here is BUY on DIPS !!

Buy BALRAMPUR CHINI MILLS LTD.

Cmp : 125

Buy on Dip Till : 100-110

Stoploss : 90

Target : 180

Timeframe : 12-18 Months. (may be Faster)

The Stock is expected to perform Very well as Our Agro Theme is Doing Really Brilliant Job. We Caught is very Early and Enjoying the Gains as of now. I have alerted many times regarding the Stimulus and It's Long Term Impacts. AGRI is the Sector to focus in coming days. Many things are Changing and The Focus of the Stimulus was to Strengthen the Rural Economy with Boost to Agriculture.

Trade with your Risk Management and Trade with care !!

Here I am Concluding the Stocks From Our MARKET OUTLOOK Series.

-----------------------------------------------------------------------------------------

WE HAVE COMPLETED 17 STOCKS SO FAR... Will POST MORE SOON!!

-----------------------------------------------------------------------------------------

The Stocks Given Below are PENNY STOCKS and Are VERY RISKY, Posting a Few here, Do Not Enter if you can't Risk your Capital with these Picks !!

These Are not the Part of our Basic Recommendations...

-----------------------------------------------------------------------------------------

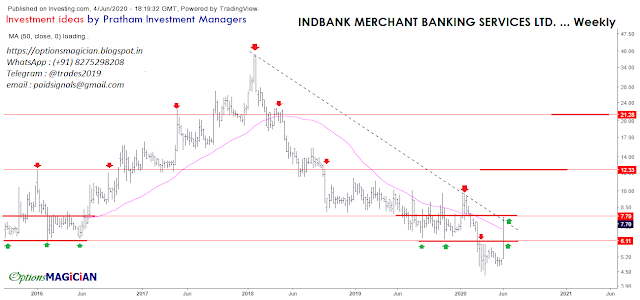

1) INDBANK MERCHANT BANKING SERVICES LTD.

Breakout on a Weekly Timeframe, Strong Base Created in 6 to 7.80 levels. Above 7.80 levels, One Can Buy with a Stoploss of 6 and a Target of 12.30 and Above That 21 may be seen.

Follow Chart, Do not Trade and Hold Blindly.

-----------------------------------------------------------------------------------------

2) INDIAN OVERSEAS BANK LTD.

Weekly Chart Suggests a Strong Breakout above 10.80 Levels. Sustaining above 10.80, Buy With a Stoploss of 9 and Targets of 15 & 22, If Market Supports We might see 30+ also.

-----------------------------------------------------------------------------------------

3) MOREPEN LABORATORIES LTD.

Again a Weekly Chart, Breakout from Falling Trendline Above 18 Rs. Sustaining above 18 will give 23 - 29 and Possibly 42 Levels if market Supports. Trade Carefully. Stoploss for this Will be Close below 15.

-----------------------------------------------------------------------------------------

4) PC JEWELLERS LTD.

Daily Chart, Breakout from a falling Trendline. A Close Above 14 Rs. will take it to 24 levels. Above 24 we might see 36 also. Stoploss for the Same will be 10.

Trade at your Own Risk, Keep the Charts of these Picks always in front to watch levels. Do not Buy and Forget these Stocks, these are not Fundamentally Good stocks, these are Just Technical Reactions due to Overall Rally in markets.

Will Post Few More in NEXT BLOG POST ...

-----------------------------------------------------------------------------------------

We are Nearing the Closing of Registrations For EQUITY PLUS (2.0).... Those Who haven't Completed the Registrations, Do the Needful at the Earliest Possible !!

We Have Limited Seats Left Now. We are Reaching our targeted Numbers. It was a Great Response and We Thank you All For your Faith in our Analysis and Dedication in Work. We Will Deliver the Results as per our Strength.

WE are Currently SHORT of ONLY 8 MEMBERS.... Can We Complete the Magical 100 ??

NEXT BATCH will not be Available Soon... !!

If You are Still on SIDELINES Waiting For Something... Forget Everything and Register Today !!

Drop a Message On WhatsApp : (+91) 8275 298 208

Write a Mail to : service@planmymoney.in

-----------------------------------------------------------------------------------------

Next Stock in Our Watch list is :

ZENSAR TECHNOLOGIES LTD.

A Stock from IT Sector ..

Starting with Monthly Chart ..

Zensar Technologies , I have no ideas about the Fundamentals but Technically The stock looks great for a Superb Move.

Monthly Chart Shows a Rising Channel since 1998 till now, Size of the Channel is big so upper and lower ends are far away. The Main Support Line of the Channel is very rarely touched, As per the Chart, It is touched Twice only. First was in 1998 and then during Market Crash of 2008-2009.

The Stock this time Touched Lows in March 2020, The Lows done were around the Highs IT Boom of 2000. The Stock Fail Drastically in last 12-18 months from the Channel Resistance to the Channel Support. As We can see a Support From 200 Period Moving Average also worked near the lows.

The Stock Reversed From the Lows around 60 levels, Moved Above the 200 Period SMA and Above the Resistance which worked Well in 2000. Stock is comfortably moving above the Levels which will work as a Support now onwards. Next Resistance is placed around 148 levels only.

Stock was trading around 100 levels when chart was downloaded, After the day Stock Moved 20% exactly on the next day. I was unable to Publish the blog due to Connectivity and Electricity issues due to the Thuderstorm #Nisarga. Yesterday The Stock corrected with market.

Let's See a Little Closer View..

This was the Structure on Daily Chart, The Stock Closed Slightly above the Resistance giving a nice Breakout and The Next day we saw a sharp 20% upside move. Now the Stock will Relax a bit and Will give an opportunity for entry to all those who missed the stock. Currently Trading around 114, I am Expecting the Stock to Cool down before further move.

The Recommendation here will be BUY the Dips !!

Buy ZENSAR TECHNOLOGIES LTD.

Cmp : 114

Buy on Dips 100-111

Stoploss : 85

Targets : 144 - 222

The Stock has the Potential to Double From it's Current Rates. The Ride will not be an easy ride. Risk : reward in this case is amazing. 20 Rs. Risk For a Reward of 100 - 111 Rs. gain is a Mouthwatering Trade for any Equity Investor.

Trade Carefully as the Stock may move wild. Call us For Such Amazing Stocks Regularly. If You Haven't Joined Our EQUITY PLUS and EQUITY MARVELS Services, Please Be Fast ... WE ARE CLOSING EQUITY PLUS (2.0) .. in 2 Days.

-----------------------------------------------------------------------------------------

EQUITY PLUS (2.0) is a Journey from 2 Lacs to 1 Crore... Details are Available on the Blog. Check Top of the Blog and Click on the 2nd Tab Near Home Tab.

The Link is here EQUITY PLUS (2.0) Hurry up !! Only 8 Seats Left !!

-----------------------------------------------------------------------------------------

Next Stock in Our List is a SUGAR Stock.

BALRAMPUR CHINI MILLS LTD.

Monthly Chart of Blarampur Chini Shows a Strong Counter moving in Rising Trend continuously since last 20 years. The Stock wasn't able to Cross a All time high of 180-190 since last 14+ years. Many Corrections are seen in this Stock and it returned to Supports and Trend lines Multiple times, Whenever touches the Supports, Moves up again respecting the Supports. The Stock is seen to move within some boundaries everytime. It gives us a extremely Predictable Stock to Trade. Buy at Support, Sell at Resistance kind of Stock. Even a Kid Can Understand the Buying/Selling in this Stock.

Recently touched a Trendline Support, Reversed Sharply to form a Long Pin Bar Candle, Moved Near the Stronger Level of 99 for quite sometime, again The Candle was a Strong Bullish Candle in May, Exactly on Trendline Support. The 100 Period Simple Moving Average Worked Perfectly in this area. After the Strong Close in may. The Stock Moved Above the Resistance on 99 and Strongly trading above the level. When the Chart was downloaded, the Stock was trading around 112 levels, Today it is trading around 125 levels.

Recommendation here is BUY on DIPS !!

Buy BALRAMPUR CHINI MILLS LTD.

Cmp : 125

Buy on Dip Till : 100-110

Stoploss : 90

Target : 180

Timeframe : 12-18 Months. (may be Faster)

The Stock is expected to perform Very well as Our Agro Theme is Doing Really Brilliant Job. We Caught is very Early and Enjoying the Gains as of now. I have alerted many times regarding the Stimulus and It's Long Term Impacts. AGRI is the Sector to focus in coming days. Many things are Changing and The Focus of the Stimulus was to Strengthen the Rural Economy with Boost to Agriculture.

Trade with your Risk Management and Trade with care !!

Here I am Concluding the Stocks From Our MARKET OUTLOOK Series.

-----------------------------------------------------------------------------------------

WE HAVE COMPLETED 17 STOCKS SO FAR... Will POST MORE SOON!!

-----------------------------------------------------------------------------------------

The Stocks Given Below are PENNY STOCKS and Are VERY RISKY, Posting a Few here, Do Not Enter if you can't Risk your Capital with these Picks !!

These Are not the Part of our Basic Recommendations...

-----------------------------------------------------------------------------------------

1) INDBANK MERCHANT BANKING SERVICES LTD.

Breakout on a Weekly Timeframe, Strong Base Created in 6 to 7.80 levels. Above 7.80 levels, One Can Buy with a Stoploss of 6 and a Target of 12.30 and Above That 21 may be seen.

Follow Chart, Do not Trade and Hold Blindly.

-----------------------------------------------------------------------------------------

2) INDIAN OVERSEAS BANK LTD.

Weekly Chart Suggests a Strong Breakout above 10.80 Levels. Sustaining above 10.80, Buy With a Stoploss of 9 and Targets of 15 & 22, If Market Supports We might see 30+ also.

-----------------------------------------------------------------------------------------

3) MOREPEN LABORATORIES LTD.

Again a Weekly Chart, Breakout from Falling Trendline Above 18 Rs. Sustaining above 18 will give 23 - 29 and Possibly 42 Levels if market Supports. Trade Carefully. Stoploss for this Will be Close below 15.

-----------------------------------------------------------------------------------------

4) PC JEWELLERS LTD.

Daily Chart, Breakout from a falling Trendline. A Close Above 14 Rs. will take it to 24 levels. Above 24 we might see 36 also. Stoploss for the Same will be 10.

Trade at your Own Risk, Keep the Charts of these Picks always in front to watch levels. Do not Buy and Forget these Stocks, these are not Fundamentally Good stocks, these are Just Technical Reactions due to Overall Rally in markets.

Will Post Few More in NEXT BLOG POST ...

-----------------------------------------------------------------------------------------

We are Nearing the Closing of Registrations For EQUITY PLUS (2.0).... Those Who haven't Completed the Registrations, Do the Needful at the Earliest Possible !!

We Have Limited Seats Left Now. We are Reaching our targeted Numbers. It was a Great Response and We Thank you All For your Faith in our Analysis and Dedication in Work. We Will Deliver the Results as per our Strength.

WE are Currently SHORT of ONLY 8 MEMBERS.... Can We Complete the Magical 100 ??

NEXT BATCH will not be Available Soon... !!

If You are Still on SIDELINES Waiting For Something... Forget Everything and Register Today !!

Drop a Message On WhatsApp : (+91) 8275 298 208

Write a Mail to : service@planmymoney.in

-----------------------------------------------------------------------------------------

Declaration:

The Analyst, SHINDE ATUL S. is a Financial Adviser by Profession. He is Having an experience of nearly 13 years in Stock markets in India and Around the World with a Client base spread across the World for Indian as well as Global Market Advisory. The Readings are Completely based on Analysis of Charts and The Analyst possesses all the Rights to be Wrong in his analysis.

The Analyst, SHINDE ATUL S. is a Financial Adviser by Profession. He is Having an experience of nearly 13 years in Stock markets in India and Around the World with a Client base spread across the World for Indian as well as Global Market Advisory. The Readings are Completely based on Analysis of Charts and The Analyst possesses all the Rights to be Wrong in his analysis.

Consult your Financial Adviser, Manage Risk, No Leverage, Positional holding with patience.

-----------------------------------------------------------------------------------------

Stock Market Advisory : (+91) 8275 298 208

Stocks and Mutual Fund Related : service@planmymoney.in

For Paid Services : paidsignals@gmail.com

For Training Programs on Technical Analysis : training@technicalanalysis.online

-----------------------------------------------------------------------------------------

-----------------------------------------------------------------------------------------

#equityplus #equitymarvels #equity #stocks #stockmarkets #nse #bse #nifty50 #nifty #sensex #trading #investing #midcap #smallcap #largecap